Liability Insurance Ontario Tenant

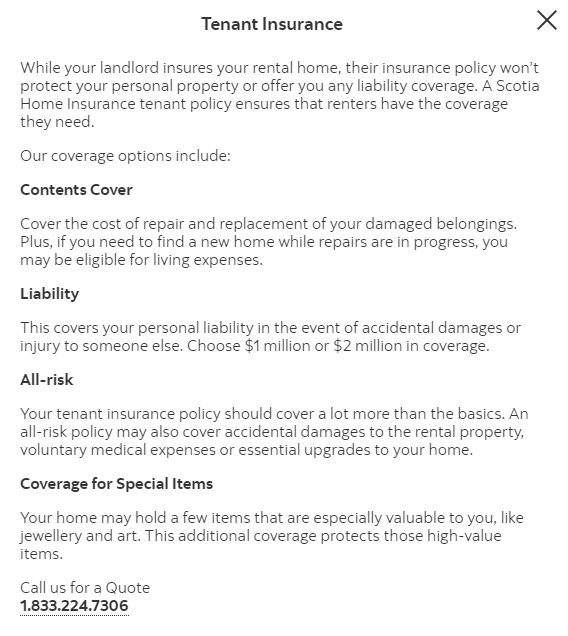

It may also cover liability in case of damage to the building or an accident that affects a guest or visitor to the building. Compare rates from leading carriers.

How To Remove A Driver From Usaa Auto Insurance Di 2021

Give Us a Call.

Liability insurance ontario tenant. You need to have at least 1 million in liability coverage in case a claim happens and you are deemed to be liable for it. What Does Tenant Insurance Cover. Typically this type of insurance policy covers up to 1000000.

The landlord is not responsible to cover your belongings. Ad Easy-to-understand insurance for your business from Canadas top providers. Ad Easy-to-understand insurance for your business from Canadas top providers.

Why Having Ontario Apartment Insurance is a Growing Necessity Liability awards are growing more and more expensive each year. Make sure that you have the right amount of tenants legal liability insurance as part of your CGL policy. Compare rates from leading carriers.

Buy tenant insurance online in 5 minutes. Whats more tenant insurance covers more than just your possessions with the typical plan covering you for personal liability up to 1 million. Buy within minutes using our hassle-free platform.

Insurance for tenants traditionally covers your belongings from theft fire and severe weather conditions. Typically a landlord will require tenants to have insurance as a rental condition in the lease. Busting myths about tenant insurance in Ontario Myth.

Customers visiting your property using your products or hiring your expertise want to ensure theyre working with a respectable company that stands by their products and services. Based on the customized plan that you get liability protection for you as the tenant is included. Whether youre renting a condo in Toronto a house in Ottawa or a basement apartment in Mississauga Sonnet tenant insurance is made just for you.

Ontario liability insurance helps keep businesses operating during the legal process and gives employees peace of mind that their work is protected. Canadian tenants legal liability coverage is not a stand-alone insurance product it is actually just one of many parts of the typical Commercial General Liability Insurance policy which is a common product that nearly every business carries. Personal Liability insurance coverage protects you if someone is unintentionally injured in your home or if youve damaged someone elses property and now have to pay for damages.

According to the Landlord and Tenant Board the law does not require you to have tenant insurance and your landlord cannot force you to get it. Get customized coverage in language you can understand at a competitive price and do it all online. As a tenant you may be liable for any damage you cause to your building or unintentional harm caused to others who live in or visit the property.

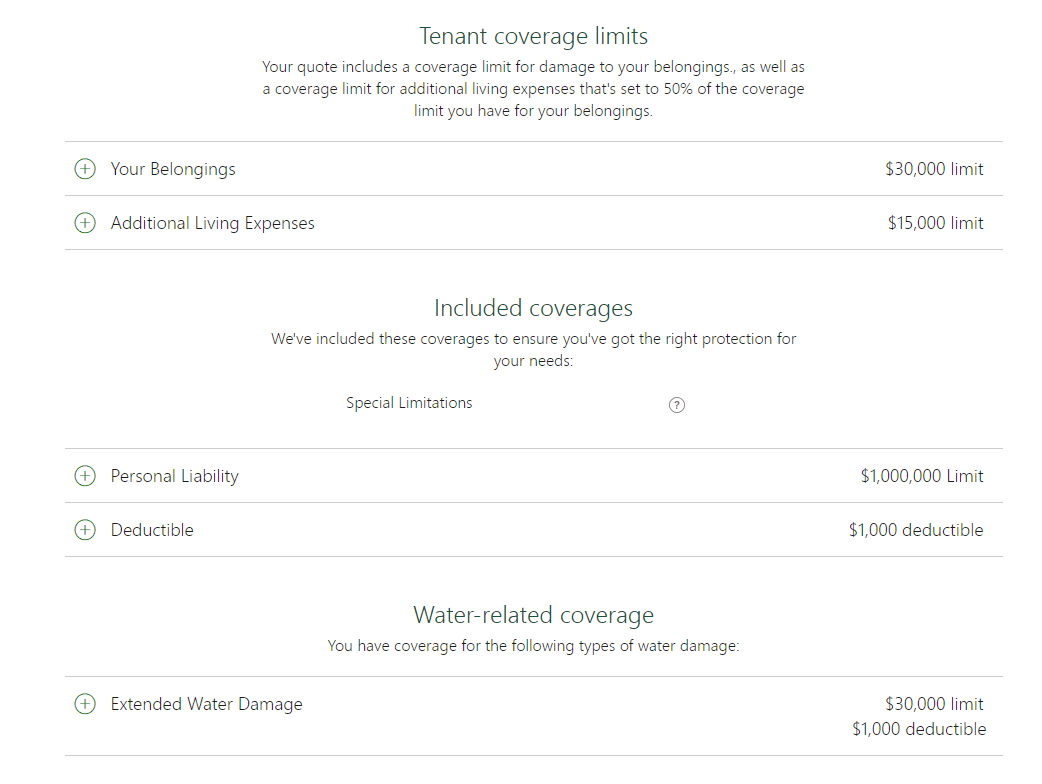

Personal Liability is a coverage designed to protect you legally if you accidentally injure someone or they are hurt on your property. However your liability portion can usually be. We usually recommend an all-risk or comprehensive policy with content limits of at least 30000 and a personal liability limit of at least 1000000.

If you dont have tenant insurance you are on the hook to pay for any damages. A babysitter slips on a spill on your kitchen floor and injures her back. Renters dont need any home insurance.

Sonnet Insurance has Ontario tenants covered. Buy within minutes using our hassle-free platform. Liability can cover you for things like your guests medical bills if they are injured on your property or as a.

Replacement Cost means that in the event of a covered claim items will be repaired to their original condition or replaced with new items of like kind and quality with no deduction for depreciation. The amount of tenant insurance youll need in Ontario will depend on how much it will cost to replace your stuff and how much protection you want. However if you agreed to get tenant insurance as part of your lease agreement and then you dont do it your landlord could give you a notice to terminate the tenancy and then file an application with the LTB to evict you.

Tenants Legal Liability Insurance If your business rents a space your general liability policy may not fully cover you if you or your employees are responsible for damage to the rented property. The liability coverage included in a homeowners condo or tenant insurance plan protects you financially if you unintentionally cause bodily injury or property damage to othersat your home or anywhere in the world. Insurance Tenant and Renters Insurance Tenant Renters Insurance in Ontario Tenant Renters Insurance in Ontario Whether youre going to school at the University of Toronto working at a factory in Windsor or retired in Bonfield renting is a great way to avoid being tied down and enjoy maintenance-free living anywhere in Ontario.

How much does Tenant Insurance cost per month in Ontario. While theres no law that says you need tenant insurance to rent living space you do need to sign contracts most of the time. False in practical terms.

Tenant Insurance is much more affordable than home insurance since it only covers possessions liability and additional living expenses.

How Landlords Can Help You Sell Tenant Insurance Canadian Underwriter

Tenant S Waiver Of Insurance Ezlandlordforms

Prudent Tenants Carry Insurance Coverage As Protection Against Potential Liability Owed To Landlord Papadakis Legal Services Toronto 647 979 4141

Nova Scotia Hall And Or Kitchen Rental Agreement Form In 2021 Rental Agreement Templates Template Site Legal Forms

Get The Real Tenant Insurance Averages In Ontario And By City

Tenant Insurance In Canada Your Guide To The Basics Of Renter S Insurance How To Save Money

Tenant Insurance A Complete Guide For Renters

Compare Landlord Insurance Quotes Cheaper Get Buy To Let Insurance From The Best Companies With Uk La Being A Landlord Landlord Insurance Insurance Comparison

Tenant Insurance In Canada Your Guide To The Basics Of Renter S Insurance How To Save Money

Https Www Regionofwaterloo Ca En Living Here Resources Documents Housing Services Renters Toolkit Docs Admin 2236461 V1 Securing Housing Tenant Insurancecsdaccessible Pdf

What Is Personal Liability Coverage For Renters Insurance

Tenant S Insurance In Oshawa Lindsay W B White Insurance

Tenant Insurance Renters Insurance Ontario Absolute Insurance

Is Tenant Insurance Mandatory In Ontario

Requiring Insurance Coverage Involves A Lease Term Mandating That A Tenant Obtain Insurance Protection Dk Legal Practice Oakville 416 906 6663

Post a Comment for "Liability Insurance Ontario Tenant"