Supplemental Life Insurance And Ad&d

Supplemental life insurance vs ADD Some employers offer supplemental benefits which can include life insurance. It only covers accidents not natural death or injury from illness.

Protocol Insurance Agent Medical Insurance Life Insurance Premium

Supplemental employee life and ADD You may elect the following coverage.

Supplemental life insurance and ad&d. Supplemental Life and ADD Insurance You can purchase Supplemental Life and ADD Insurance in increments of 10000. You must enroll in supplemental lifeADD if you want to cover your spouse. Amounts over 50000 require Evidence of Insurability EOI and must be approved by Unum to be effective.

Supplemental Life and Voluntary ADD Coverage. If you elect Employee Supplemental Life and ADD Insurance you may purchase Spouse. Here are the top 10 comparisons for Supplemental Life Insurance Vs Add based on our research.

You can also purchase additional insurance for yourself your spouse andor your children. The maximum amount you can purchase cannot be more than 5 times your annual Salary or 300000. While an ADD policy provides benefits to your beneficiaries when you die the caveat is.

Eligibility for Supplemental Life and ADD benefit is a minimum of 20 hours per week or 5 full-time equivalency on a. In many instances the supplemental life insurance that your employer offers you is in reality an ADD insurance policy and shouldnt be confused with a standard life insurance policy. A life insurance rider is an addendum to a policy that provides additional coverage.

ADD insurance premiums are as low as 60 per year depending on the amount of coverage you buy and the benefits it provides. However coverage cannot exceed 5 times your Annual Earnings. You can purchase Supplemental Life and ADD Insurance in increments of 10000 10000 minimum to a 500000 maximum.

How much Spouse Supplemental Life and ADD can I purchase. Supplemental employee life 10000 to 500000 in increments of 10000 Supplemental employee ADD 10000 to 600000 in increments of 10000. These policies may not require a medical exam and are given group rates based on age.

ADD insurance is not a replacement for life insurance. In many cases this type of policy will also cover a. Didnt Read Supplemental ADD insurance sometimes offered alone or as a supplement to other life insurance programs provides additional money to your beneficiaries in the event you die or become.

One available option in many group or life insurance plans is supplemental ADD insurance which protects against accidental death and dismemberment. If you elect an amount that exceeds the guaranteed issue amount of 80000 you will need to. That is you can purchase ADD insurance or burial insurance on the private market.

You can purchase Supplemental Life and ADD Insurance each in increments of 5000 up to. No benefit is payable if the death is due to natural causes or other. How much can I purchase.

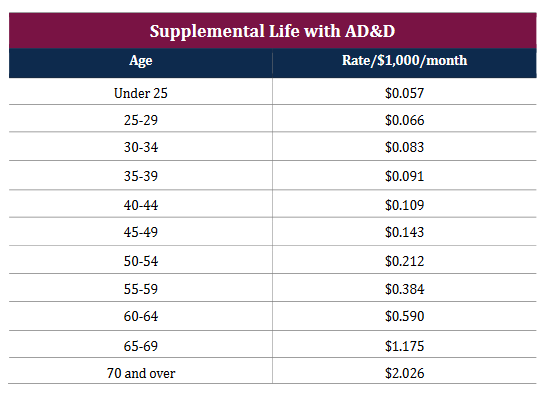

Supplemental employee life insurance adds coverage to your own policy. For information about Supplemental Life Insurance and Voluntary ADD Insurance. Paycheck costs for Voluntary Life and ADD Insurance are based on the associates age.

You can purchase ADD insurance as a separate product or endorsement on your life insurance policy. For instance if an employee chooses 100000 the spouse can enroll in 50000. ADD is Insurance that pays an additional benefit if you are seriously injured or die due to a covered accident.

Basic and Supplemental Life Insurance pays a benefit if you die for any reason except those excluded in the certificate of insurance. Ask an expert if the life insurance company youve chosen offers an ADD rider. Supplemental spouse life insurance covers the life of your spouse.

Some employers provide employees with the option to purchase supplemental life insurance that increases coverage and does not have stipulations such as ADD or burial insurance. An ADD rider pays out an extra amount if death is due to an accident but if the death is from natural causes the policy simply pays out the base amount. This option may be.

ADD is purposed to serve as a supplement to regular life insurance as coverage is limited to certain types of accidents. For people with health issues supplemental life insurance may be more affordable than individual life insurance. In fact you may be able to buy these policies as a rider on.

Spouse coverage can be up to 50 of the employee lifeADD amount not to exceed 250000. Supplemental Life and ADD Insurance is coverage that you pay for in addition to the Basic Life ADD Insurance that Hamline may provide to you.

Benefits Employee Life Insurance

Life Insurance For Seniors Over 60 It S Possible Life Insurance Quotes Life Insurance For Seniors Life Insurance Types

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Should I Buy Group And Supplemental Life Insurance Valuepenguin

Life Insurance Plans American Fidelity

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

Post a Comment for "Supplemental Life Insurance And Ad&d"