Auto Insurance Ontario Government

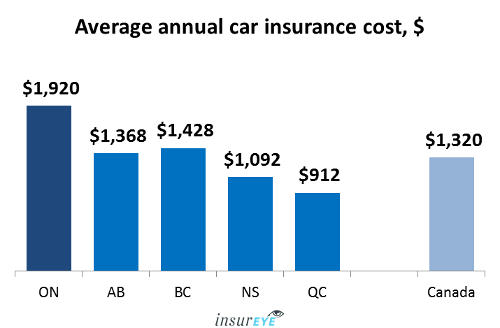

In Ontario automobile insurance is regulated by the Financial Services Commission of Ontario a regulatory agency of the Ministry of Finance. Auto insurance rates for Ontario drivers are increasing by as much as 11 per cent despite promises from the provincial government to lower rates.

Automobile Insurance Affordability Plan For Ontario Next Steps

The Financial Services Commission of Ontario FSCO a regulatory agency of the Ministry of Finance is responsible for regulating insurance including auto insurance.

Auto insurance ontario government. The chart below provides a summary of minimum coverages required by the Ontario government. Switch to GEICO and You Could Save Today. Ad Dont Overpay for Auto Insurance.

In the province 200000 in third-party liability coverage is mandatory. The Ontario government is amending a regulation under the Insurance Act to allow auto insurers to give premium rebates to policyholders for up to 12 months following the end of the emergency declared due to the coronavirus pandemic. Once approved FSRA publishes the rate changes theyve green-lighted to proceed.

All owners of vehicles in Ontario must purchase a standard auto insurance policy. You Could Save 500 or More on Car Insurance. Effective June 1 2016 to help make insurance premiums more affordable the benefits and coverages you receive in a standard auto insurance policy changed some were reduced and some options for increased coverage were eliminated or changed.

Automobile insurance in Ontario is delivered by the private sector. Drivers could opt for a new basic level of auto insurance coverage that could help reduce their auto insurance premiums or choose additional levels of medical and rehabilitation coverage. Limits Required by Law.

In Ontario the minimum liability coverage youll require for auto insurance must cover third party liability accident benefits coverage uninsured automobile coverage and direct compensation-property damage coverage. In Ontario all registered vehicles must have insurance provided by a private insurer. Ad Dont Overpay for Auto Insurance.

After an accident will cover your car your cars driver and passengers and pedestrians and property involved in. The review will examine practices in other jurisdictions and identify opportunities to achieve greater efficiencies. You Could Save 500 or More on Car Insurance.

Switch to GEICO and You Could Save Today. Ontario Mandatory Coverage To drive in Ontario you must secure coverage through a private insurer that meets the minimum provincial regulations. Granted a 00 change in auto insurance rates is.

Accident benefits and the right to sue in specific situations are set out in a combination no-fault and tort-based system. The Governments consultation will coincide with the review of Ontarios auto insurance rate regulation system which is jointly conducted by the Ministry of Finance and the Financial Services Regulatory Authority of Ontario. Ontario would provide consumers with more choice and flexibility in their auto insurance coverage under new proposals introduced November 2 2009.

In Ontario every insurance company must have changes to their auto insurance rates approved by the Financial Services Regulatory Authority of Ontario FSRA. For more information about Ontarios auto insurance system visit FSCOs Understanding Auto Insurance page. In Q1 2021 Ontario auto insurance rate changes amounted to a weighted average of 00.

A notice from the Financial Services Commission of Ontario has outlined the approved rate changes for 2020 by the Financial Services Regulatory Authority of Ontario FSRA for private passenger automobile insurance.

Compare Car Insurance Quotes In Ontario Ratesdotca Ratesdotca

Ontario Automobile Insurance Anti Fraud Task Force

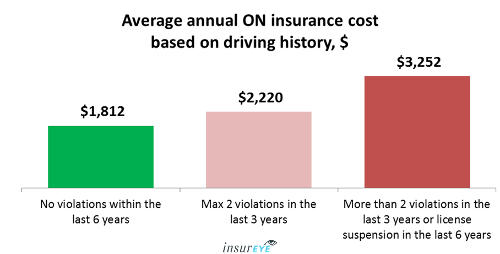

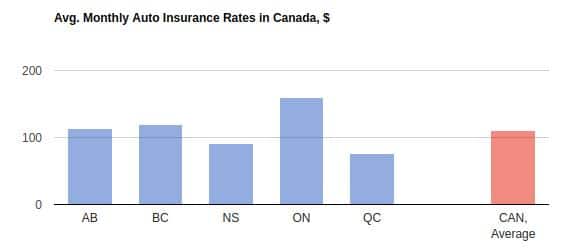

Average Car Insurance Rates In Ontario 1 920 Per Year

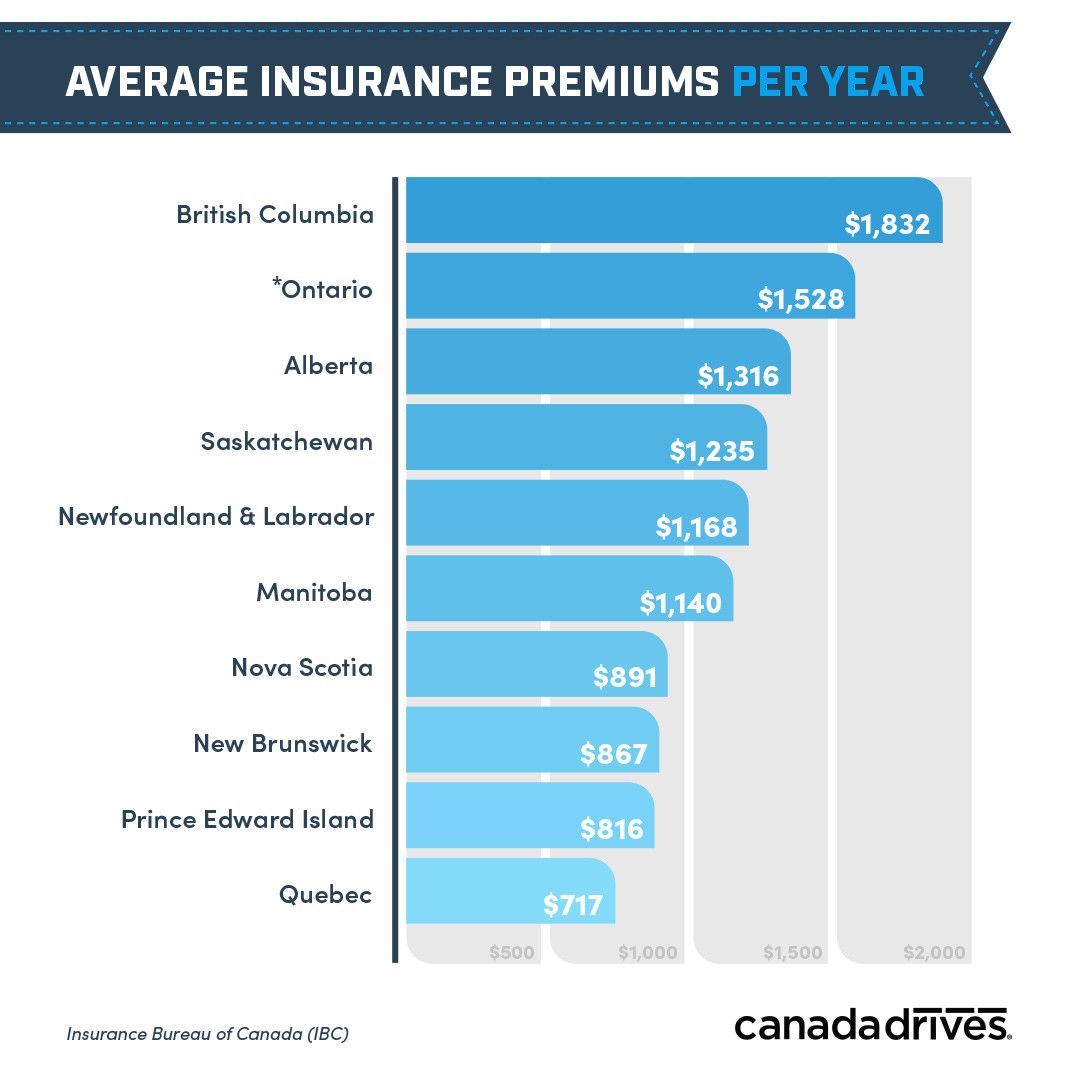

Why Ontario Drivers Pay The Highest Car Insurance Rates In The Country The Globe And Mail

Recent Changes To Auto Insurance In Ontario Paib Insurance Inc

Kanetix Ca Reveals Ontario S Most Expensive Cities For Auto Insurance

List Of The Best Car Insurance Companies In Ontario Mitchell Whale Ltd

Fair Benefits Fairly Delivered

Ontario Automobile Insurance Anti Fraud Task Force

Car Insurance In Ottawa Rates Quotes Consumer Tips

Ratesdotca Reveals The Most Expensive Ontario Cities For Auto Insurance

/https://www.thestar.com/content/dam/thestar/business/personal_finance/insurance/2012/02/19/ontario_car_insurance_good_news_and_bad_news/mvinsurance13.jpeg)

Ontario Car Insurance Good News And Bad News The Star

13 Ways To Get Cheap Car Insurance

Average Car Insurance Rates In Ontario 1 920 Per Year

Mississauga Pays Extremely High Auto Insurance Rates Report Insauga Com

Fair Benefits Fairly Delivered

Ratesdotca Reveals The Most Expensive Ontario Cities For Auto Insurance

Why We Recommend 2 Million Liability Coverage Mitchell Whale Ltd

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/SDIZZPR3FBHK5AWMITZJNZW3GA)

Post a Comment for "Auto Insurance Ontario Government"